While buying a product, a customer needs to consider both the price of the product and the tax on the product that they have to pay. In Excel, it is possible to calculate GST from either the price inclusive or exclusive of GST.

To do that, you don’t even need to use Excel-oriented functions; regular mathematical expressions will work fine. In this article, we will learn how to calculate GST in Excel, both from the price including and excluding GST.

➤ Use the following formula to calculate GST: =D2*10%

➤ Replace D2 with the price without GST.

➤ Autofill other cells in the column to get the GST for every product in the table.

That was a method of calculating GST and GST only. But you might want to calculate the price that includes GST. You might even want to know the original price without GST from a price that already includes that. To know all that, consider reading the whole tutorial. Remember to download our workbook before starting.

What is GST?

GST, or Goods and Services Tax, is a type of indirect tax that is imposed on goods and services. When someone buys something from a store or service provider, they have to pay a percentage of the gross price as tax to the government. The rate of the tax depends on the state or country you live in. For this article, we will use a flat rate of 10% for our calculations.

Calculating GST from the Price Excluding GST

When you have the prices of the products, you might want to include the GST before handing the invoice to the customer. The initial prices are usually prices excluding GST, and that will be needed to calculate the GST per product.

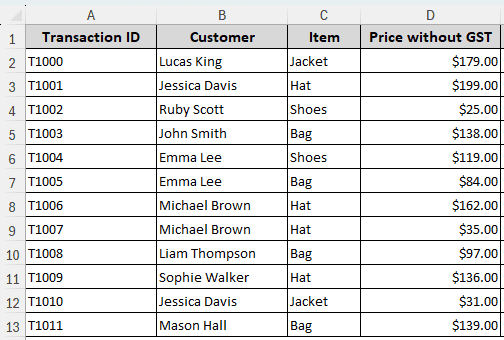

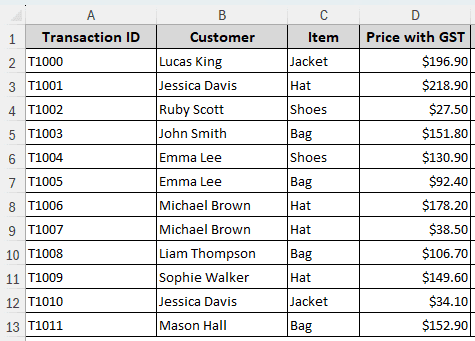

For this example, we have a dataset of some retail transactions. There are transaction IDs, customer names, items they bought, and the prices without GST. We will not use any Excel functions, just simple mathematical expressions to calculate the GST and the price that includes GST. Without further ado, let’s begin the calculation. Follow the steps below:

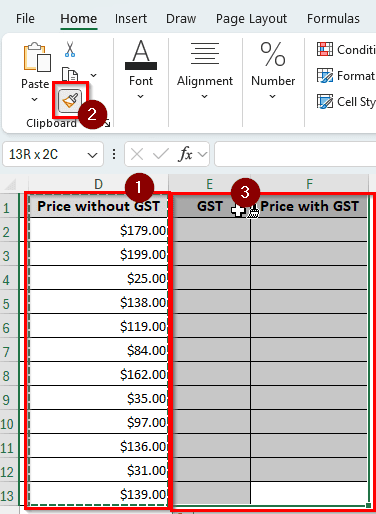

➤ First of all, we need to create two more columns for GST and Price with GST.

➤ Write those column headings in the E and F columns.

➤ Select the whole of the D column, and click on the Format Painter icon in the Clipboard section of the Home tab.

➤ Select the E and F columns to copy the formatting of the D column.

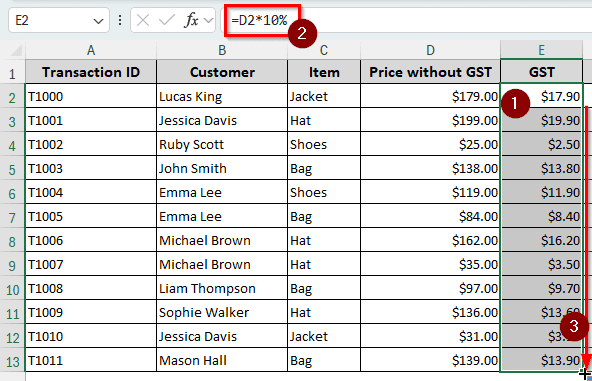

➤ In the GST column, write this formula in the cell under the heading:

=D2*10%

➤ Press Enter, and autofill other cells in the column.

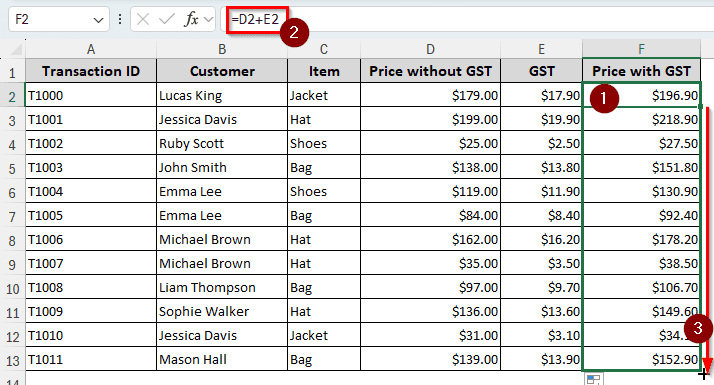

➤ Now, in the other column for Price with GST, insert either of the following formulas:

=D2+E2

=D2*110%

➤ Fill the rest of the rows by dragging the small plus (+) sign from the bottom-right corner of the F2 cell.

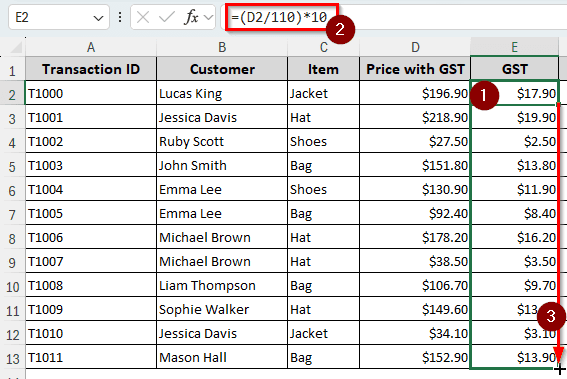

Extracting GST from the Price Including GST

If you are a customer and paid the full price of a product, you might want to know what the actual price was and how much you paid for GST. To extract GST from the prices that include GST, we are using the same dataset, but with the prices changed. We replaced the prices without GST with the prices including GST. Let’s calculate the GST from these prices:

➤ Add two columns for GST and Price without GST.

➤ Write the following formula in the E2 cell:

=(D2/110)*10

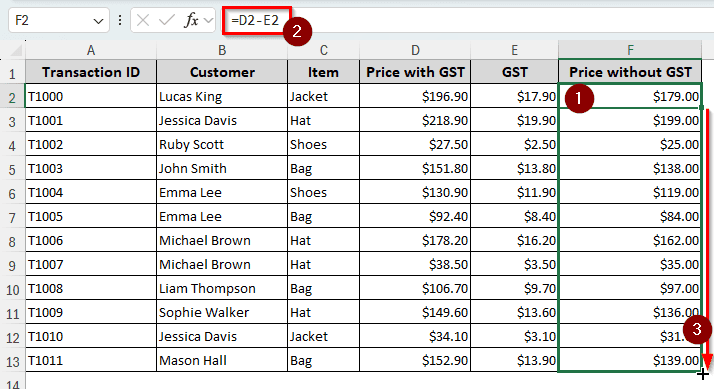

➤ Now use either of the following formulas to calculate the Price without GST.

=D2-E2

=(D2/110)*10

Frequently Asked Questions

How to get GST details?

Your company should already have the GST rates listed for you. If you are calculating for yourself, use the rates provided by the government. Remember, the rates might vary from product to product and service to service.

Is GST always 10%?

We have used 10% GST in this article for the ease of calculation. The GST rate will actually vary depending on where you live. Australia has a 10% flat rate for GST, while in the USA, there is no countrywide GST rate. However, there might be GSTs with rates varying from state to state.

Is GST the same as VAT?

It is almost the same. Some countries prefer the term GST, and some prefer VAT. Fundamentally, there are no differences, although the rules of GST vary from country to country.

What is the formula for GST in Excel?

There is no dedicated function in Excel to calculate GST. You can multiply the price by the GST percentage to calculate it. If you have the percentage in decimal, that will work too. But if it’s not, remember to add the percentage (%) sign after the GST rate.

How do you add GST to an invoice?

You can add another row/column in your invoice depending on the format you use. Right-click on the column/row and click Insert to insert a column/row in Excel.

Wrapping Up

In this article, we learned how to calculate GST in Excel. We hope that you were able to grasp the methods we followed in this article. Feel free to shoot your questions below, and we will see you in another article soon.