Calculating WACC is an important part of making financial decisions. The formula for calculating WACC seems scary at first, but in Excel, it is easy to calculate WACC using the cost of equity, cost of debt, market value of equity, market value of debt, and tax rate.

In this article, we will learn how to calculate WACC in Excel. We will go through the step-by-step guide, formulas, and other information you might need to calculate WACC. By the end of the tutorial, you will have a solid understanding of calculating WACC in Excel.

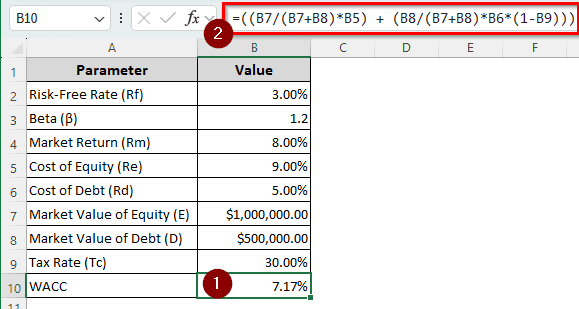

➤ Enter the following formula in the cell where you want to calculate the WACC.

=((B7/(B7+B8)*B5) + (B8/(B7+B8)*B6*(1-B9)))

➤ Replace B7 with the market value of equity, B8 with the market value of debt, B5 with the cost of equity, B6 with the cost of debt, and B9 with the tax rate.

That was a quick way of calculating WACC, but in most cases, you’d also want to calculate the cost of equity before calculating the WACC. In this article, we will go step by step on how to calculate WACC in Excel, so consider reading the whole tutorial to get a good grasp of it.

What is WACC?

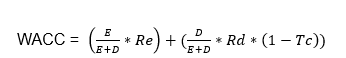

WACC, or the weighted average cost of capital, is used to calculate the average cost of capital of a company. This metric includes equity and debt, while weighing by their respective proportions for the company’s capital.

By calculating the weighted average cost of capital, a company learns how much return it has to earn on its investments so that it can satisfy the investors and creditors of the company. In the weighted average cost of capital, the cost of equity, the cost of debt, the market value of equity, the market value of debt, and the tax rate are considered.

Calculating WACC in Excel with a Regular Formula

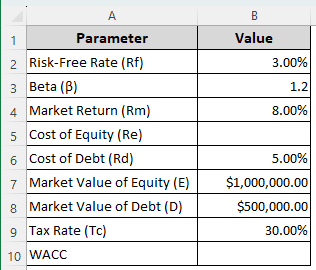

For this tutorial, we have a table with the risk-free rate, beta, market return, cost of debt, market value of equity, market value of debt, and tax rate. We must first calculate the cost of equity and then the weighted average cost of capital.

➤ Enter the following formula in the cell where you want the cost of equity (Re) to show up. That cell is B5 for our example.

=B2 + B3 * (B4 – B2)

➤ Press Enter.

=Rf + β(Rm-Rf)

We are using the cell references to insert the formula in Excel. Here, Rf is B2, β is B3, and Rm is B4.

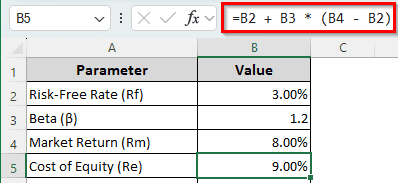

➤ Insert the following formula in the B10 cell:

=((B7/(B7+B8)*B5) + (B8/(B7+B8)*B6*(1-B9)))

➤ Press Enter to complete the calculation.

We have replaced the equation parameters with the cell references from Excel. As a result, E became B7, D became B8, Re was replaced by B5, Rd was changed to B6, and Tc refers to B9.

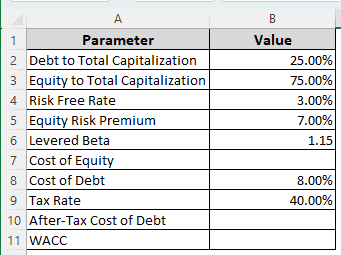

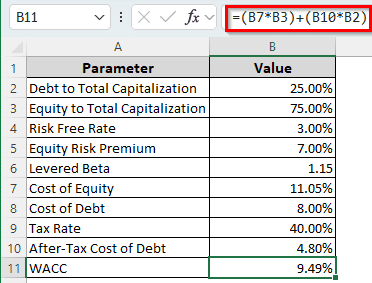

Computing WACC in Excel Without Market Values

It is possible to calculate WACC without having access to the market values of equity and debt. To elaborate on this method, we have a table with Debt to Total Capitalization, Equity to Total Capitalization, Risk Free Rate, Equity Risk Premium, Levered Beta, Cost of Debt, and the Tax Rate. We will have to calculate the cost of equity, after-tax cost of debt, and the WACC at the end.

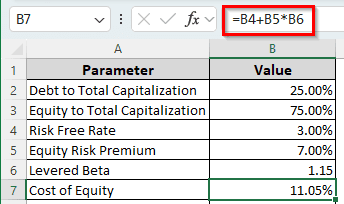

➤ Insert the following formula in the B7 cell to calculate the cost of equity:

=B4+B5*B6

➤ Press Enter and move on to the next calculation.

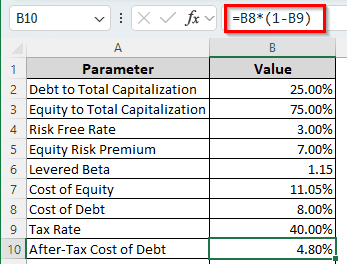

➤ Calculate the after-tax cost of debt using the following formula:

=B8*(1-B9)

➤ Press Enter to move on to calculating WACC.

➤ Insert the following formula to finally calculate the WACC:

=(B7*B3)+(B10*B2)

➤ Press Enter to see the results.

Frequently Asked Questions

What is the DCF formula for WACC?

Sometimes WACC is used as the discount rate for DCF. The formula for that can be written like the following in Excel:

=SUM(A1:A10)/(1+B1)

In this formula, the range A1:A10 contains the cash flow of each period, which we sum up using the SUM function. Then, we divide it using 1+B1, where B1 is the WACC rate.

How to reduce WACC?

A company can choose to increase its liabilities instead of the owner’s equity to reduce WACC.

What is better than WACC?

Instead of calculating WACC, you might want to calculate APV (Adjusted Present Value) for valuation. APV is not, per se, better than WACC. However, it is more complex than WACC and provides more flexibility. If your company is fairly stable, you should use WACC. If it’s not, you can go for APV.

Is IRR equal to WACC?

In order to bear the cost of capital, companies should have the IRR at least equal to, and preferably more than, the WACC. When the internal rate of return is higher than the weighted average cost of capital, the company can pay the cost of capital while making a profit.

Is a higher WACC better?

No, a higher WACC is worse because the business would need more profit to satisfy the investor. A lower WACC is always preferred over a higher one.

Wrapping Up

In this article, we learned how to calculate WACC in Excel. To practice the methods we mentioned better, download the workbook we used for this tutorial. If you have any questions, comment below for answers. Bookmark the site for more Excel tutorials, and we will see you in another article.